The Project

Biodiversity and natural capital contribute fundamentally to human well-being (CBD 1992, IPBES 2019). Based on this insight, Germany is committed to mainstream these values in decision making and accounting (CBD, Aichi Target 2). So far, societal and private decision-making only partly takes these values into account. One major reason are the large information gaps and uncertainties.

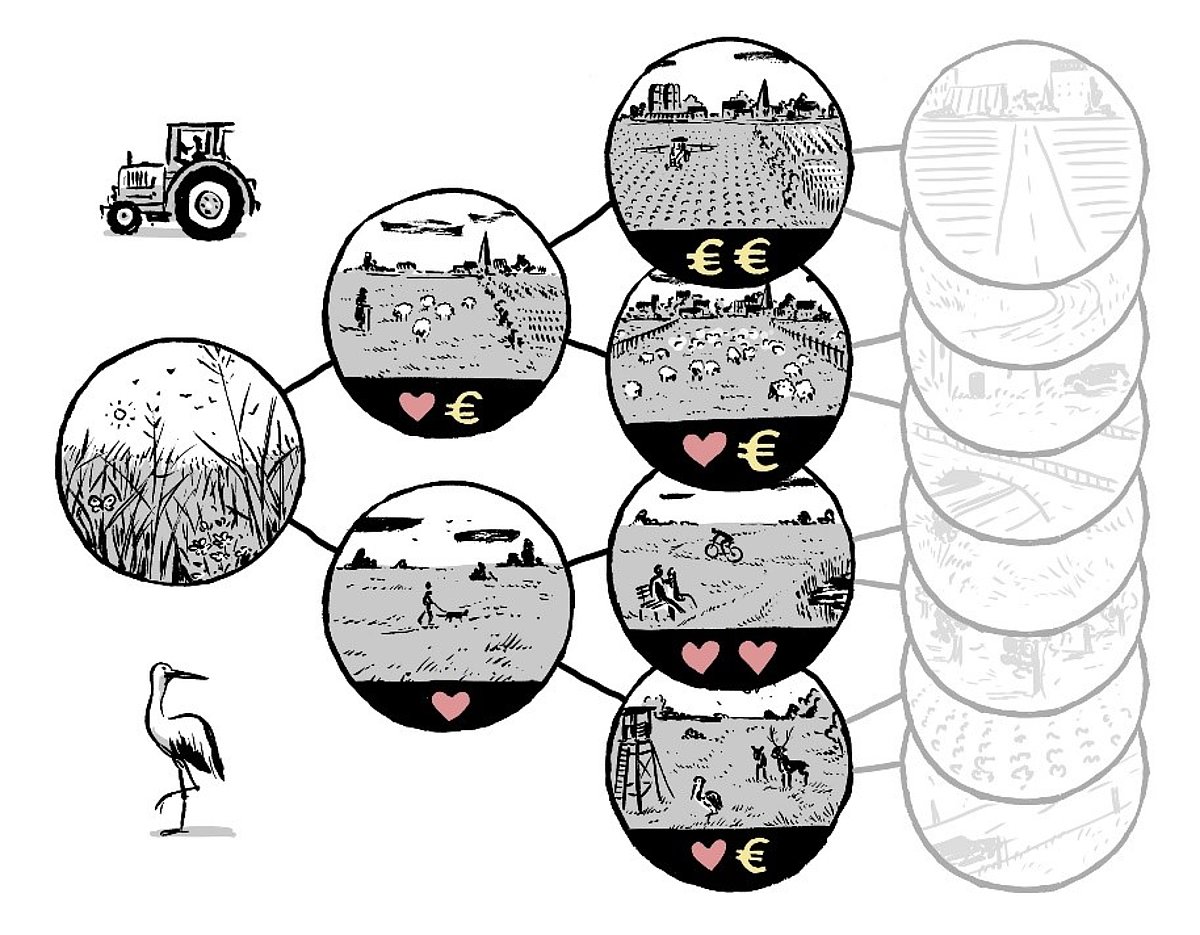

In ValuGaps, we define natural capital as stocks that deliver (ecosystem) services to humans. Biodiversity both shapes the dynamics of natural capital via biodiversity-ecosystem-functioning relationships, and is a valuable form of natural capital itself (Mace et al. 2012). Conceptually, the value of a natural capital stock is the sum of values of all future services from this stock (Daily et al. 2000). The sum is taken over values for all humans who derive benefits, or suffer, from the natural capital’s services, where individual values are weighted according to time and likelihood of occurrence (Quaas et al. 2019). To appropriately value of natural capital, decision makers have to anticipate how the future stream of ecosystem services may develop depending on the decisions taken and ecological-economic dynamic feedbacks, and how this development affects private and public val-ues of different types, including economic, health, and relational values. Despite significant efforts by large-scale projects on valuing ecosystem services and natural capital (e.g., TEEB, TEEB.de, UK NEA, IPBES assessments), there is still an urgent need for natural capital valuation approaches that are widely accepted across policy makers, science and the wider public in Germany.

In practice, as primary valuation is time-intensive and costly, mainstreaming biodiversity values requires methods to scale, transfer, and bridge values of different types from primary valuation studies across time and space, groups of beneficiaries, types of ecosystems, and types of values to estimate natural capital values for the policy or decision problem at hand. This practice of benefit transfer is commonly used and has thereby become the “bedrock of practical policy analysis” (OECD 2018, p. 157), although most approaches are theoretically weak and inappropriate in how they deal with heterogeneities between study and policy sites. ValuGaps responds to the need for providing scientifically and normatively sound valuation methods that are sufficiently easy to implement for pragmatic applied valuation. ValuGaps combines conceptual research, integrated ecological-economic modelling, behavioural experiments, and surveys to identify key parameters (including aspects of individual preferences, social and relational values, and ecosystem dynamics) required to value natural capital and to scale, transfer and bridge different types of values across space, time, groups of beneficiaries, and ecosystems. Thus, ValuGaps will significantly contribute to mainstreaming valuation of biodiversity and natural capital in Germany.

(copy 2)

-

Work Package A: Advancing the concept

WP A will study how the economic value of natural capital depends on (i) individuals’ heterogeneous risk and time preferences (expected utility, prospect theory, safety-first preferences), and how to include these in adjustment factors for benefit transfers, (ii) Knightian uncertainty about future economic and ecological prospects, expanding our previous work on en-tropic uncertainty preferences (Mittelstaedt, Baumgärtner 2020), and (iii) norms of distributive jus-tice. Specifically, we contrast traditional discounted utilitarianism (Arrow et al. 2003) with rank-dis-counted utilitarianism (Zuber, Asheim 2012) and the Rawlsian maximin criterion. Methodically, we develop theoretical models that include relevant features of the ecological-economic system, its con-stituents, and normative principles, and link these models to data on preferences (→ WP B) and empirical valuation approaches (→ WPs Q, S).

-

Work Package B: Behavioural experiments and surveys

WP B compiles and analyses a database of natural capital values for Germany, extending the work of Phase 1, and uses experiments (lab and field) and surveys to elicit preferences of stakeholders that are key for natural capital valuation (→ WP A) and for scaling and transferring values (→ WP S). This includes validated experimental and survey designs for eliciting fundamental preference parameters (substitution elasticities, inequality aversion, discount rates, risk preferences) of stake-holders, and measurement of their individual perspectives on ecosystem regeneration and perceived uncertainties.

-

Work Package Q: Quantification of natural capital values in Germany

WP Q focuses on (i) urban green and (ii) high-nature value farmland, especially grasslands, and (iii) the role of ecosystems for species conservation. For a nation-wide study on urban green, we use the life satisfaction method (“experienced prices”) using SOEP data (Krekel et al. 2016), contrasted to results from hedonic pricing. A focus will be on distributive and sorting effects. For grassland, we focus on recreational services and contrast results from different methods (life satisfaction, travel costs, discrete choice experiments) in an own valuation study for 10,000 households, living within 14km around 100 grassland locations. For biodiversity conservation, we further develop the economic and ecological basis for biotope value points and replacement cost, and amend this valuation approach accordingly.

-

Work Package M: Modelling ecosystem dynamics, management & benefits

WP M combines different modelling approaches to link bio-physical ecosystem processes and functions to the provision of eco-system services under different management regimes. This ranges from statistical assessments of habitat properties and resulting services to highly complex process-based models. We then integrate economic models of decision-making to include feedback loops on future management actions in the model. Finally, we will include social objectives (→ WP A) to quantify present values of the dif-ferent natural capital stocks. WP C will also analyse how uncertainties in underlying bio-physical properties, climate conditions, ecosystem processes, socio-economic conditions and management affect the derived values of biodiversity and natural capital.

-

Work Package N: Non-economic values of natural capital and biodiversity

WP N will assess relational values (Chan et al. 2018) with a focus on species-rich grasslands, by means of participatory ecosystem service mapping with the reference stakeholder network, questionnaires in the ValuGaps multi-site grassland valuation study, and life satisfaction data. We quantify and assess health values (Marselle et al. 2019) by analysing large-scale epidemiological cohort studies, with a focus on stress reduction, and analyse SOEP panel data on life satisfaction to quantify the role of urban green for life satisfaction.

-

Work Package S: Scaling, transferring and bridging values

WP S develops ready-to-use methods to scale and transfer natural capital values in light of heterogeneities in time, space, uncertainties, beneficiary groups and eco-systems, and studies how to bridge between different types of values (→ WPs A and N). We plan to dynamically extend formulas of Baumgärtner et al. (2017a) for the aggregate value of a public nat-ural good as function of mean income, income inequality, the substitution elasticity between public natural and private human-made goods, and the quantity of the ecosystem service provided. We derive transfer functions, and empirically quantify transfer errors using a panel of identical valuation studies on urban green for 22 major German cities. WP S also conducts the multi-site valuation study for grassland in Germany (10,000 households around 100 grassland sites; three survey waves to account for seasonality), including participatory ecosystem service mapping, stated preferences (dis-crete choice experiment), revealed preferences (travel cost method), and (experienced) life satisfaction.

-

Work Package D: Decision-support

WP D combines science and practice to develop guidance for decision-making, accounting and planning. This includes the integration of key results into the UBA Methodological Convention for the Assessment of Environmental Costs, a step-by-step guide on benefit transfer in Germany (containing methods and parameters), an online database for value estimates and key parameters, and an online natural capital calculator. WP D tests ‘beta versions’ of these products with the ValuGaps reference stakeholder group. Co-development with prac-titioners will ensure that (i) the developed methods meet the requirements of the practice (‘testing workshops’ hosted at UBA), and (ii) inform and train practitioners in transferring and scaling values (‘training workshops’ hosted at UBA).